ED attaches three hotels worth Rs 100 crore in PMC Bank fraud

Mangalore Today News Network

New Delhi, Sep 18, 2020: The Enforcement Directorate (ED) has attached three hotels in Delhi worth Rs 100 crore in connection with its money laundering probe in the Punjab and Maharashtra Cooperative (PMC) bank fraud, officials familiar with the development said.

The agency has so far attached unmortgaged properties worth around Rs 360 crore in the scam belonging to the promoters of HDIL - Rakesh and Sarang Wadhawan, officials said.

The PMC Bank scam, which came to light last year, is a unique case when it comes to money laundering investigations as the ED has for the first time not touched properties which are free of any encumbrance or are mortgaged with the bank. This was done in consultation with the Reserve Bank of India, which had taken control of PMC Bank in September last year over concerns expressed by thousands of depositors. ED had given a no-objection certificate (NOC) in November 2019 for the bank to recover the money from HDIL’s mortgaged properties, said an officer cited above.

Among the assets attached on Friday include - Hotel Conclave Boutique at A-20, Kailash Colony; Hotel Conclave Comfort at D-150, East of Kailash and Hotel Conclave Executive at C-22, Kalkaji, which are allegedly owned by Libra Realtors Pvt Ltd, M/s Deewan Realtors Pvt Ltd, Rakesh Kumar Wadhawan, Romy Mehra, and M/s Libra Hotels Pvt Ltd and its Directors; companies linked to HDIL, according to the second ED officer.

The second officer said that three hotels are now known as Fab Hotels.

The anti-money laundering probe agency also said in a statement on Friday that “investigation revealed that proceeds of crime totaling Rs 247 crore were obtained fraudulently by M/s Libra Realtors Pvt Ltd, M/s Deewan Realtors Pvt from PMC Bank in the guise of loans. These loans are part of the Rs 6117 crore owed by HDIL group of Companies to PMC Bank”.

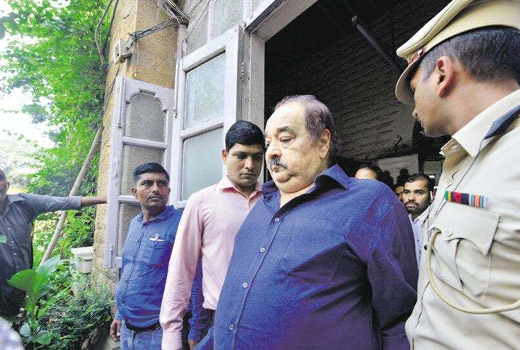

The ED had initiated a probe under prevention of money laundering act (PMLA) in the case in October last year against Housing Development Infrastructures Ltd (HDIL), its promoters Rakesh Kumar Wadhawan, Sarang Wadhawan, bank’s chairman Waryam Singh and then Managing Director Joy Thomas and others on the basis of a FIR by Economic Offences Wing of Mumbai Police.

The ED has found that Wadhawans have laundered more than Rs 2500 crore out of a total around Rs 6600 crore that the company - HDIL - had taken from PMC Bank between 2007 and 2013.

Earlier, assets belonging to accused Rakesh Kumar Wadhawan and Wadhawan Family trust totalling to Rs 193 crore were also attached and jewellery worth 63 crore was seized.

Rakesh Kumar Wadhawan and his son Sarang Wadhawan were arrested by ED on October 17, 2019 and they are presently in judicial custody.

courtesy:Hindustan Times

- Puttur: Employee sentenced to three years jail in restaurant cash theft case

- Akshata Poojary case: Complaint and counter-complaint against Brahmavar police transferred to CID

- Traditional cockfighting: Need for discussion and appropriate decision, says Speaker Khader

- Mangaluru: Bharath Shetty slams Congress government over anti–hate speech Bill, calls it threat to free expression

- Mangaluru celebrates Christmas with prayers, grand festivities

- Moodbidri: Body of man found in Hosanagady river; suicide suspected

- Banks urged to help customers reclaim Rs 140 crore lying in inactive accounts in Dakshina Kannada

- Changes in train services due to South Western Railway works

- MCC forms three teams to crack down on illegal flexes and banners in Mangaluru

- 9th Edition ’Mangaluru Kambala’ on December 27

- Udupi Bishop Dr Gerald Isaac Lobo extends Christmas greetings

- Mangaluru: Eight members of cattle-theft gang arrested by Bajpe police

- Belthangady Navoor murder case: Court acquits wife citing mental illness despite murder conviction

- After IndiGo crisis, Aviation Ministry gives nod to two new Indian airlines

- Vote for me, win SUV, Thailand trip, gold: Pune poll candidates to voters

- PM Modi attends Christmas service at Delhi church, greets citizens

- Minister R Ashoka accuses Congress of cheating 1.26 crore Gruha Lakshmi beneficiaries

- Centre imposes complete ban on new mining leases in Aravalli

- Byrathi Basavaraj moves High Court for anticipatory bail in murder case

- Nine charred to death as truck rams into private bus near Chitradurga

- Rohit Sharma, Virat Kohli smash statement hundreds on Vijay Hazare Trophy return

- Uddhav, Raj announce political alliance ahead of municipal bodies poll

- We’re biggest fugitives: In new video, Lalit Modi, Vijay Mallya taunt India

- SIR 2.0: 3.67 crore voters dropped from draft electoral rolls across 11 states and UTs

- India’s ’Baahubali’ rocket places heaviest-ever satellite in orbit

- Mangaluru Student Goes Missing; Ullal Police Register Case

- APD Foundation Joins WHO Civil Society Commission

- Daiva’s prediction comes true: Janardhan Reddy walks free from jail

- Skills and Competencies Take Center Stage at MSN Dialogue Series

- Court remands Maoist Lakshmi to six-day police custody

- Sandhya Shenoy honored with Society for Materials Chemistry Medal-2024

- White Cornus Apartment in Mangaluru

- City girl wins first place in state-level spell bee competition

- Alleged ‘Love Jihad’ Case in Mangaluru: Woman left home voluntarily, says police

- Girl fatally struck by reckless two-wheeler near Belman

- New residential complex for the judges inaugurated in Mangaluru

- Absconding accused nabbed after 8 years

- Truck with cylinders turns turtle in Beltangady

- Bhoota Kola artist dies of cardiac arrest

- Development of the country should be our goal: Ganesh Karnik

- CITY INFORMATION

- TRAVEL

- TOURIST INFORMATION

- HEALTH CARE

- MISCELLANEOUS

Write Comment

Write Comment E-Mail To a Friend

E-Mail To a Friend Facebook

Facebook Twitter

Twitter  Print

Print