Cafe Coffee Day Siddhartha death: CBDT starts probe

Cafe Coffee Day Siddhartha death: CBDT starts probe

Mangalore Today News Network

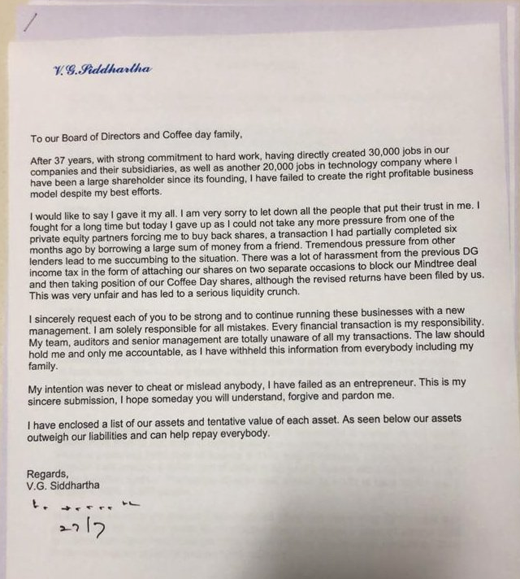

Bengaluru, Aug 16, 2019: Cafe Coffee Day founder VG Siddhartha’s purported suicide note had triggered intense speculation because he had alleged that harassment from the Income Tax department and other extraneous pressures had pushed him to take the extreme step. In fact, he specifically named BR Balakrishnan, the previous Director General-Investigations, Income Tax, Karnataka and Goa Range, in his letter addressed to CCD board members and employees. The Central Board of Direct Taxes (CBDT) has now initiated an inquiry into this allegation.

"There was a lot of harassment from the previous DG Income Tax in the form of attaching our shares on two separate occasions to block our Mindtree deal and then taking position of our Coffee Day shares, although the revised returns have been filed by us. This was very unfair and has led to a serious liquidity crunch," read Siddhartha’s letter dated July 27. The CCD founder went missing two days before that, and his body was fished out from the backwaters of Netravati river by local fishermen at the break of dawn on July 31.

Sources told the Business Standard that said the apex body for direct taxes has sought explanation from Balakrishnan, who previously served as the principal chief commissioner of Income Tax for Karnataka and Goa, and had ordered attachment of Coffee Day shares when he was in-charge of the Bengaluru region. They added that all information regarding the allegations is being gathered. Balakrishnan retired last month.

In the wake of the outrage sparked by Siddhartha’s letter, especially on social media under ’tax terrorism’, the Income Tax Department refuted all charged in a press release dated July 30. The department said the provisional attachment of shares was made by the department to protect the interests of revenue, a norm in cases of large tax evasion. It added the search on a prominent politician’s case (DK Shivakumar) had led to credible evidence of concealed transactions by CCD and after search operations on Siddhartha’s company and other properties, he had admitted to not revealing unaccounted money of around Rs 480 crore. The department had also pointed out the signature on the letter did not match Siddhartha’s as available in his annual reports.

"He [Balakrishnan] is a man who is credited with some successful investigations and known to run quite effective operations," said a senior DG level officer who was earlier in Bengaluru. Explaining the procedure, he said search operations are either conducted by an assistant commissioner or a deputy commissioner level person. The search papers, however, would need authorisation from the Commissioner of Income Tax, while the DG briefs and oversees the processes.

The CBDT has reportedly been pitching for a non-adversarial regime, to maximise revenue collection but with impeccable and friendly conduct by officials. In its annual action plan for 2019-20, the CBDT specified that "taxpayer outreach programme shall be conducted so that every range head conducts interactive sessions to educate taxpayers on specific tax provisions and initiatives taken by the tax department". It added that this is a critically important area for achieving the objectives of a fair and transparent administration and high standards of taxpayer service, which ultimately translates into higher levels of voluntary compliance.

Courtesy:Yahoo.com

- Educational, financial institution shut due to Lok Sabha election 2024 in these areas

- Supreme Court verdict tomorrow on 100% EVM-VVPAT verification

- 6 Dead as massive fire engulfs Patna hotel, over 50 feared trapped, watch

- Horlicks, Boost drop ’Health’ label, rebranded as "Functional, Nutritional drink"

- Not One Vote: Mamata Banerjee’s big message after 26,000 teachers lose jobs

- On complaints against PM Modi, Rahul Gandhi, poll body’s notice to parties

- RBI plans curbs on suspect bank accounts to fight cyber fraud: Report

- Sunita Kejriwal to lead AAP’s Lok Sabha campaign in Delhi, hold roadshows

- ’Desperation born from fear of defeat’: Siddaramaiah slams Modi, defends 4% Muslim quota

- ED challenges Arvind Kejriwal’s plea in Supreme Court: ’173 phones destroyed’

- 103-year-old CSK fan flaunts love for cricket, wishes to meet MS Dhoni

- How an Indian heart saved a Pakistani teen’s life

- Karnataka Lok Sabha election: Voting timings, Key candidates and phase 2 polling constituencies

- Sullia: Rider dies in bike-jeep collision

- Mangaluru: Mustering process held ahead of LS polls

- Mangaluru: BJP accuses Congress of circulating fake pamphlet

- Over 2.88 crore voters in Karnataka to cast their franchise on April 26

- Communally sensitive DK dist was a narrative created by few: Captain Brijesh Chowta

- BJP protests against Congress government’s ‘anti-people’ policies

- Renowned Yakshagana Bhagavatha Subrahmanya Dhareshwar no more

- People must support Congress to develop DK as land of harmony: Padmaraj

- Railways to operate special trains to clear extra rush during election day

- BJP, Congress candidates end campaign by conducting roadshows in Mangaluru

- There is no Modi wave in DK: Harish Kumar

- Railways to operate election special trains from Bengaluru to Mangaluru, Kundapura

- New residential complex for the judges inaugurated in Mangaluru

- Absconding accused nabbed after 8 years

- Truck with cylinders turns turtle in Beltangady

- Bhoota Kola artist dies of cardiac arrest

- Development of the country should be our goal: Ganesh Karnik

- Container truck gets stuck under Modankap railway bridge

- Truck crushes bike’s pillion rider near BC Road

- Head constable dies of heart attack

- Udupi: PDO dismissed over financial irregularities

- CREDAI to resume Skill Development Program for Construction Workers in Mangaluru

- John B Monteiro elected president of Rachana Catholic Chamber of Commerce & Industry

- Sudhanshu Rai elected district president of All College Student Association

- Chief Minister to visit Mangaluru, Udupi on August 1

- Nitte University awards PhD degree to Tina Sheetal D’Souza

- Sachitha Nandagopal honoured by CMTAI for Community Service

- CITY INFORMATION

- TRAVEL

- TOURIST INFORMATION

- HEALTH CARE

- MISCELLANEOUS

Write Comment

Write Comment E-Mail

E-Mail Facebook

Facebook Twitter

Twitter  Print

Print