Taking a cab or owning a car: Here’s how the costs add up

Taking a cab or owning a car: Here’s how the costs add up

Mangalore Today News Network

Sep 12, 2019: Finance Minister Nirmala Sitharaman recently said that one of the reasons for a slowdown in sales in the automobile industry is because millennials prefer taking cabs like Uber and Ola services to buying cars.

That statement stirred up a debate over a cup of coffee, which led to some back of the envelope calculations as to what works out more economical – buying a car like the Maruti Suzuki Wagon-R or riding in one run by Uber or Ola?

We present to you the gist of the back of the envelope calculations. Before that, some assumptions have been made.

Assumptions

This calculation does not take into account rising fuel costs and differential insurance rates. The calculation is based on a daily commute of just 25 Km. Petrol price has been assumed to be Rs 72 per litre constant, even though it is likely to change over a period of time.

It also assumes that the car has been bought outright. If you were to factor in a car-loan, then the interest payments will increase overall ownership cost by about Rs 1.15 lakh more.

It also does not take into account parking charges, toll charges and other incremental costs over the period of ownership, just to keep calculations simple. (Obviously, if one owns a car, they are going to use it for other trips as well, not just driving to work and back.)

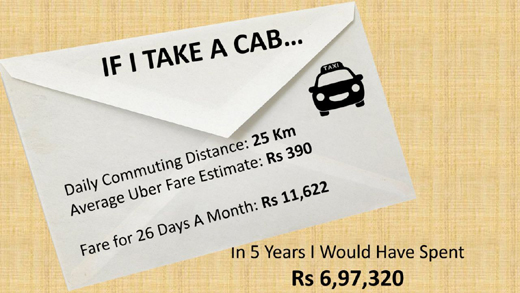

If You Take A Cab To Work

The average fare on the Uber app for a distance of 25 Km in Delhi works out to between Rs 341 to Rs 447 from its estimator for Uber Go. Hence, it’s been rounded off to Rs 390 (including base fare) for ease of calculation. All things being constant, you will end up spending about Rs 11,622 a month.

There are obvious advantages like not having to bother with parking or maintenance. The only discomfort is probably the wait times and quality of the cars that come to ferry you.

If you use cabs every day to get to work and back, you will end up spending Rs 6,97,320 in five years.

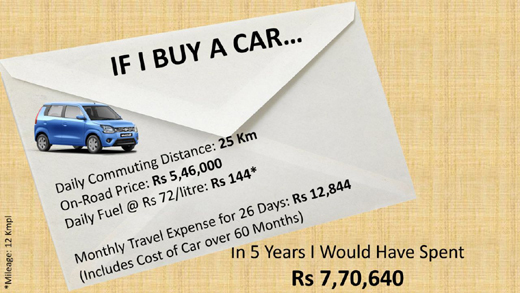

Now how would it work out if you bought a small car like the Maruti Suzuki Wagon-R, which is what most Uber drivers use?

If You Buy A Car

This example assumes that you have bought the car outright with savings from your piggy bank and hence doesn’t include interest payments. The on-road price of a Wagon-R VXi is Rs 5.46 lakh.

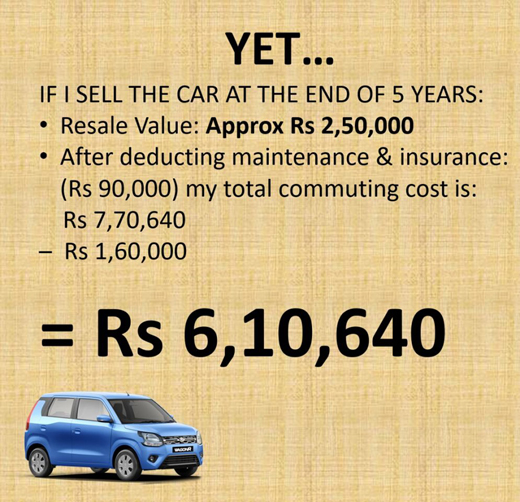

Assuming you use the car only to work and back, with it giving about 12 Kmpl in city conditions, in five years, you will end up spending Rs 7.70 lakh commuting with your own car.

Works out more expensive? Not quite. There’s more.

Wait There’s More...

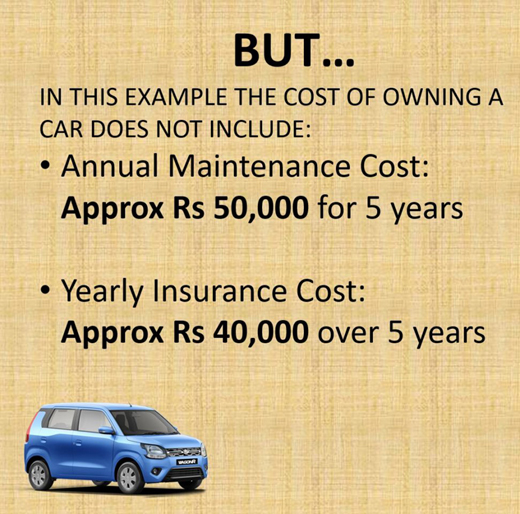

We still haven’t factored in insurance and maintenance costs. Plus the loan payments, if any. Factor that in and you end up paying even more to commute to work.

However, there is a catch. The car is a depreciating asset, but it can recover some of your money for you when you sell it.

There are advantages and disadvantages to owning a car. One has to factor in unproductive time spent driving. If you hire a driver, then factor in another Rs 15,000 per month as salary, which makes it unviable. Then there are the parking charges, toll charges and general upkeep.

However, you do have the pleasure of owning your own car, keeping it the way you want, listening to your choice of music and having it at your beck and call, anytime of the day and night.

Courtesy:Yahoo.com

- Infosys techie in Bengaluru arrested for secretly filming Woman In Toilet

- After tigers, over 20 monkeys found dead in Chamarajanagar district; poisoning suspected

- Bangladesh’s deposed PM Hasina sentenced to six months in prison by ICT

- Bengaluru Stampede: Govt moves HC against CAT order revoking IPS officer’s suspension

- Trump proposes time limit on student visas in move to remove immigrants

- No paucity of funds in Karnataka for development, assures Surjewala

- Dalai Lama says his Trust will lead search for his successor

- Telangana pharma plant explosion: Death toll rises to 36

- "Will not accept intimidation": Zohran Mamdani to Donald Trump over arrest threat

- Indian Navy contains fire on board Palau-flagged tanker with 14 Indian crew

- Delhi begins ban on fuel sale to old vehicles; AI cameras, traffic police teams deployed at pumps

- Surjewala continues meetings with Congress MLAs in Karnataka

- Puttur: Two arrested in prostitution racket bust at Samethadka

- Press Day: ’Trust in print media remains strong’, says Walter Nandalike

- Mangaluru: Car catches fire after hitting electric pole to avoid dog

- Changes in train services to facilitate track maintenance works in Palakkad division

- ’Will be Karnataka CM for five years’ says Siddaramaiah amid buzz of leadership change

- LKG, UKG classes launched in DK and Udupi Anganwadis; English training begin

- Karkala’s Ayush Shetty wins U.S. Open badminton title

- Missing lovers from Kumble traced in Udupi

- Bantwal: Absconding murder attempt accused arrested after 8 years

- Mulki Abdul Latif murder case: Accused arrested after three years

- No link between Covid vaccine and sudden deaths, health ministry clarifies

- Didn’t discuss leadership change with MLAs, MPs in Karnataka: Congress leader Surjewala

- Railway ticket fares increased from today

- Daiva’s prediction comes true: Janardhan Reddy walks free from jail

- Skills and Competencies Take Center Stage at MSN Dialogue Series

- Court remands Maoist Lakshmi to six-day police custody

- Sandhya Shenoy honored with Society for Materials Chemistry Medal-2024

- White Cornus Apartment in Mangaluru

- City girl wins first place in state-level spell bee competition

- Alleged ‘Love Jihad’ Case in Mangaluru: Woman left home voluntarily, says police

- Girl fatally struck by reckless two-wheeler near Belman

- New residential complex for the judges inaugurated in Mangaluru

- Absconding accused nabbed after 8 years

- Truck with cylinders turns turtle in Beltangady

- Bhoota Kola artist dies of cardiac arrest

- Development of the country should be our goal: Ganesh Karnik

- Container truck gets stuck under Modankap railway bridge

- Truck crushes bike’s pillion rider near BC Road

- CITY INFORMATION

- TRAVEL

- TOURIST INFORMATION

- HEALTH CARE

- MISCELLANEOUS

Write Comment

Write Comment E-Mail

E-Mail Facebook

Facebook Twitter

Twitter  Print

Print