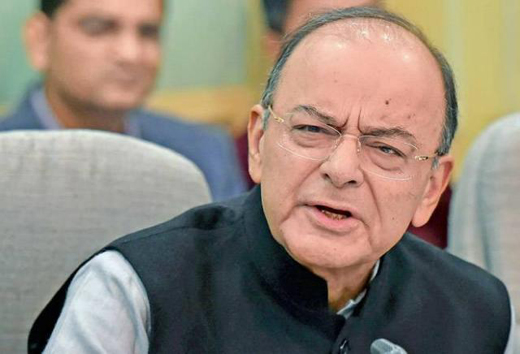

Budget 2018-19: Arun Jaitley may hike income tax exemption limit from Rs 2.5L to Rs 3L

Mangalore Today News Network

New Delhi, Jan 10, 2018 : The middle class is likely to get some relief in the 2018-19 budget which is expected to reflect a please-all strategy as it is the last regular budget of the BJP-led government ahead of the general elections in 2019. According to senior officials, the finance ministry is considering a proposal to hike the personal income tax exemption limit from Rs 2.5 lakh per annum to Rs 3 lakh or more and also introduce some changes in the tax slabs to lighten the taxpayers’ burden.

The government is working on various combinations and permutations to arrive at the right mix which ensures that the tax burden is not unreasonable and at the same time enough resources are mobilized for infrastructure development, a senior official said. The government is aware of the fact that middle-income families are facing the brunt of rising inflation and easing the tax burden would provide some relief. A reduction in the tax burden would also place more disposable income in the hands of consumers which would increase the demand for goods and services and spur economic growth, he explained.

However, the flip side is that tax base is very narrow and the government is struggling to bring down the fiscal deficit which poses a major constraint in providing tax concessions beyond a point, the official lamented. Finance Minister Arun Jaitley will have to do a fine balancing act. He had left the tax slabs unchanged in the 2017-18 budget but provided marginal relief to small taxpayers by reducing the rate from 10 per cent to 5 per cent for individuals with annual incomes between Rs 2.5-5 lakh.

Clearly, the budget will have to have a pro-farmer tilt which means more resources have to be mobilized for agriculture and rural development, the official added. The finance ministry is also considering a suggestion to provide tax exemption on fixed deposits in banks in the same manner as mutual funds in order to encourage savings by households so that more funds come into banks. These can then be used to extend loans.

The holding period for short-term capital gains (STCG) tax on listed securities may also be extended from one year to three years, bringing equities on a par with some other asset classes in tax treatment. This is among a number of measures for the capital markets that may be announced in the Budget for 2018-19. The STCG tax on stocks and mutual funds is 15 per cent at present. Listed securities held above a year do not attract any tax.

Industry chamber CII has in its pre-Budget memorandum to the finance ministry sought a reduction in the peak tax slab from 30 per cent to 25 per cent. However, it is unlikely that the ministry will concede ground due to pressure on the fiscal deficit. The subdued indirect tax collection following the roll out of the Goods and Services Tax from July 1 last year has put pressure on the fiscal deficit, which has been pegged at 3.2 per cent of the GDP for 2017-18.

The government recently raised the borrowing target by additional Rs 50,000 crore for the current fiscal to meet the shortfall. However, the government expects GST collections to pick up in the next fiscal as the teething problems of the new tax regime are being resolved.

courtesy:yahoo

- Kasaragod: SIT formed to nab accused in child abduction case

- Udupi farmer makes Rs 3 lakh per kilogram of mangoes from his terrace garden

- Youth turns Good Samaritan; rescues child from well

- Nitte Institute of Hospitality Services exploring the World of Bartending as a career choice

- Puttur: Man dies after surgery in hospital; family alleges medical negligence

- Ullal: Pillion rider dies in collision between 2 scooters

- Udupi: BJP demands resignation of Home Minister Parameshwara

- Mangaluru International Airport reunites missing woman with family

- Raghupathi Bhat files nomination as rebel BJP candidate for South West Graduates constituency

- Alleged terror link case: BM Idinabba’s grandson gets bail from Delhi HC

- Belthangady: Coconut tree catches fire due to lightning strike

- Murder accused veterinarian remanded to judicial custody

- CCB cops arrest 4 with Rs 6.5 lakh worth MDMA

- Over 30% Covaxin takers suffered health issues after a year, claims study

- "Slapped 7-8 times, kicked in chest, stomach": Swati Maliwal in FIR

- Hubballi murder case: Key accused ’on run’ after stabbing woman to death arrested

- "Shameless": Nirmala Sitharaman slams Arvind Kejriwal in Swati Maliwal row

- Air India flight collides with tug truck before takeoff at Pune airport: Report

- Bengaluru: 20-year-old college student found dead at home with slit marks on neck, wrist

- Kerala Doctor operates on 4-year-old’s tongue instead of finger, suspended after outrage

- Nepal bans sale of Everest, MDH spices over safety concerns

- Swati Maliwal undergoes medical check-up, has internal injuries on face: Sources

- LS Elections 2024: 66.95% voter turnout recorded in first 4 phases of polls

- Hassan sexual abuse case: SIT investigation not in right direction, says H D Kumaraswamy

- Kerala man sentenced to life for sexual assault of six-year-old daughter

- New residential complex for the judges inaugurated in Mangaluru

- Absconding accused nabbed after 8 years

- Truck with cylinders turns turtle in Beltangady

- Bhoota Kola artist dies of cardiac arrest

- Development of the country should be our goal: Ganesh Karnik

- Container truck gets stuck under Modankap railway bridge

- Truck crushes bike’s pillion rider near BC Road

- Head constable dies of heart attack

- Udupi: PDO dismissed over financial irregularities

- CREDAI to resume Skill Development Program for Construction Workers in Mangaluru

- John B Monteiro elected president of Rachana Catholic Chamber of Commerce & Industry

- Sudhanshu Rai elected district president of All College Student Association

- Chief Minister to visit Mangaluru, Udupi on August 1

- Nitte University awards PhD degree to Tina Sheetal D’Souza

- Sachitha Nandagopal honoured by CMTAI for Community Service

- CITY INFORMATION

- TRAVEL

- TOURIST INFORMATION

- HEALTH CARE

- MISCELLANEOUS

Write Comment

Write Comment E-Mail To a Friend

E-Mail To a Friend Facebook

Facebook Twitter

Twitter  Print

Print