Lok Sabha passes GST Bill, paving way for uniform tax regime

Mangalore Today News Network

New Delhi, May 06, 2015: The long-pending GST bill was approved by Lok Sabha on Wednesday after a walkout by Congress even as government vowed to compensate states for any revenue loss and assured that the new uniform indirect tax rate will be much less than 27 per cent recommended by an expert panel.

The Constitution Amendment Bill to implement the Goods and Services Tax (GST), originally mooted by the UPA, was passed by 352 votes against 37 after the government rejected the opposition demand of referring it to Standing Committee.

Prime Minister Narendra Modi was not present in the House at the time of voting.

Opposition members moved several amendments to the bill which was negated. Some members like Saugata Roy of Trinamool Congress and B Mahtab did not move some of the amendments after assurances by the Finance Minister.

The GST, which is proposed to be implemented from April 1, 2016, will subsume excise, service tax, state VAT, entry tax, octroi and other state levies.

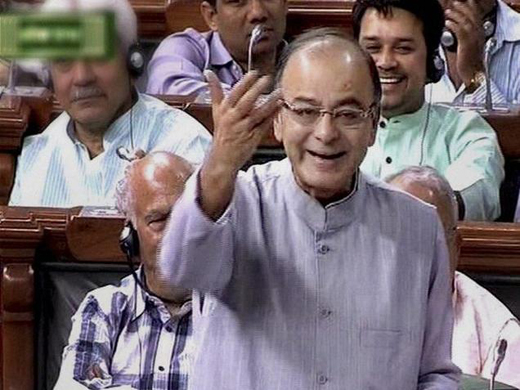

Replying to the debate on the bill before Congress walked out, Finance Minister Arun Jaitley said the proposal to reform the indirect taxes has been pending for the last 12 years and his predecessor P Chidambaram had also mooted it during UPA rule.

Rejecting the Opposition demand for referring the Bill to the Standing Committee, he said the panel has already examined various provisions of the new legislation and several of its suggestions have been incorporated.

“A bill is not a dancing instrument that it will be jumping from Standing Committee to Standing Committee,” he said.

Commending the bill, he said this is a “very important moment” because the whole process of indirect taxation in India will change once the GST is implemented.

With regard to a recommendation of an expert panel for revenue-neutral GST rate of 27 per cent, Mr. Jaitley said it is “too high” and will be “much diluted”.

He said GST would ensure seamless and uniform indirect tax regime besides lowering inflation and promoting growth in the long run as he sought to allay concerns of the states that they would be hurt by its implementation.

Courtesy: The hindu

- Karnataka government focusing on harnessing more solar power, says Energy Minister

- Pedestrian fatally run over by tanker at Kulur

- Karkala: Forest fire engulfs vast tracts of land

- Maintenance works in Palakkad division; changes in train services

- Udupi: Bike-tipper collision claims rider’s life

- Kadaba acid attack victim writes CET in Mangaluru

- EC dismisses concerns as Kasaragod mock poll sparks row

- Malpe: 3 tourists washed away by strong tidal waves; 2 rescued; 1 drowns

- IMD predicts rain, thunderstorms across Karnataka for next 3 days

- WhatsApp will soon let you see which of your friends were recently online

- Kasaragod: SC asks EC to check reports of EVMs registering ‘extra votes’ for BJP in mock polls

- Elect a representative who works for you, Hegde tells voters

- St Joachim church Kadaba, commemorated its Centenary celebration on April 17

- "Are we in Pak or Afghanistan?" Actor, husband attacked by mob in Bengaluru

- Air India suspends flights to Tel Aviv till April 30 amid Iran-Israel clash

- H5N1 strain of bird flu found in raw milk from infected animals: WHO

- Not love jihad: Karnataka govt amid outrage over woman’s murder in college

- Indian embassy advises Indians to reschedule non-essential travel as UAE reels under historic floods

- Almost 0% voting in 6 Nagaland districts over separate territory demand

- Amit Shah files nomination from Gandhinagar: ’Rose from booth worker to MP’

- Supreme Court’s big order on voter awareness rallies amid prohibitory orders

- Elon Musk’s message of peace amid Israel-Iran tensions: ’Send rockets to stars’

- Rajinikanth, Kamal Haasan, Dhanush, Vijay Sethupathi vote in Chennai

- Vice Admiral Dinesh Tripathi appointed as next Indian Navy chief

- Iran shoots down several drones, US officials suspect Israel: 10 points

- New residential complex for the judges inaugurated in Mangaluru

- Absconding accused nabbed after 8 years

- Truck with cylinders turns turtle in Beltangady

- Bhoota Kola artist dies of cardiac arrest

- Development of the country should be our goal: Ganesh Karnik

- Container truck gets stuck under Modankap railway bridge

- Truck crushes bike’s pillion rider near BC Road

- Head constable dies of heart attack

- Udupi: PDO dismissed over financial irregularities

- CREDAI to resume Skill Development Program for Construction Workers in Mangaluru

- John B Monteiro elected president of Rachana Catholic Chamber of Commerce & Industry

- Sudhanshu Rai elected district president of All College Student Association

- Chief Minister to visit Mangaluru, Udupi on August 1

- Nitte University awards PhD degree to Tina Sheetal D’Souza

- Sachitha Nandagopal honoured by CMTAI for Community Service

- CITY INFORMATION

- TRAVEL

- TOURIST INFORMATION

- HEALTH CARE

- MISCELLANEOUS

Write Comment

Write Comment E-Mail To a Friend

E-Mail To a Friend Facebook

Facebook Twitter

Twitter  Print

Print