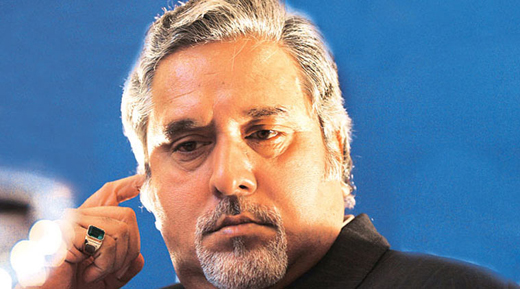

CBI raids Vijay Mallya’s office, residence on loan-default case

mangaloretoday.com

Bengaluru, Oct 10: CBI on Saturday carried out searches at residential and official premises of liquor baron Vijay Mallya and his now-defunct company Kingfisher Airlines in five places in connection with alleged default of over Rs 900 crore loan from IDBI Bank.

CBI sources said searches were carried out at the offices and residence of Mallya in Mumbai, Goa, Bangalore and other places.

They said a case was registered by the agency against Mallya, Director of defunct Kingfisher Airlines; the company; A Raghunathan, Chief Financial Officer of the Airlines; and unknown officials of IDBI Bank.

It is alleged that the loan was sanctioned in violation of norms regarding credit limits.

No immediate reaction was available from the company.

The CBI sources said an FIR into the alleged violations was registered recently as part of its wide probe into criminal aspects of loans declared to be non-performing assets by public sector banks.

The sources said there was no need for the bank to take the exposure outside the consortium.

Mallya would soon be called for examination in connection with the case.

“It was first exposure to the bank. There was no need for the bank to take the exposure outside the consortium when already other loans were getting stressed,” a senior CBI official, probing the matter, had earlier said.

The bank will have to explain reasons for extending the loan to the airlines, ignoring its own internal report which has warned against such a move.

The debt-laden airlines stopped operations in October 2012.

The CBI sources said the agency has registered a total of 27 inquiries and cases with regards to “bad loans” given by public sector banks to various corporates in 2013.

The consortium of 17 banks had an outstanding of over Rs 7,000 crore on loans from Kingfisher with State Bank of India having the highest exposure of Rs 1,600 crore.

The then CBI Director Ranjit Sinha had said bulk of non-performing assets were connected to 30 defaulter accounts.

A CBI spokesperson said in New Delhi that a case of criminal conspiracy under IPC section 120-B, along with criminal breach of trust provisions of the Prevention of Corruption Act, was filed in the matter.

“It is alleged that officials of IDBI colluded with the Promoters/Directors and CFO of the said Airlines and sanctioned credit limits of Rs 900 crore (approx.) in violation of banking norms, thereby causing loss to the said bank by such fraudulent act,” the spokesperson said.

- Pedestrian fatally run over by tanker at Kulur

- Karkala: Forest fire engulfs vast tracts of land

- Maintenance works in Palakkad division; changes in train services

- Udupi: Bike-tipper collision claims rider’s life

- Kadaba acid attack victim writes CET in Mangaluru

- EC dismisses concerns as Kasaragod mock poll sparks row

- Malpe: 3 tourists washed away by strong tidal waves; 2 rescued; 1 drowns

- IMD predicts rain, thunderstorms across Karnataka for next 3 days

- WhatsApp will soon let you see which of your friends were recently online

- Kasaragod: SC asks EC to check reports of EVMs registering ‘extra votes’ for BJP in mock polls

- Elect a representative who works for you, Hegde tells voters

- St Joachim church Kadaba, commemorated its Centenary celebration on April 17

- BJP seeks Rahul Gandhi’s answer to State’s ‘bankruptcy’

- Not love jihad: Karnataka govt amid outrage over woman’s murder in college

- Indian embassy advises Indians to reschedule non-essential travel as UAE reels under historic floods

- Almost 0% voting in 6 Nagaland districts over separate territory demand

- Amit Shah files nomination from Gandhinagar: ’Rose from booth worker to MP’

- Supreme Court’s big order on voter awareness rallies amid prohibitory orders

- Elon Musk’s message of peace amid Israel-Iran tensions: ’Send rockets to stars’

- Rajinikanth, Kamal Haasan, Dhanush, Vijay Sethupathi vote in Chennai

- Vice Admiral Dinesh Tripathi appointed as next Indian Navy chief

- Iran shoots down several drones, US officials suspect Israel: 10 points

- Voting in 21 states today as India’s National Election begins: 10 Points

- India likely to deliver first batch of Brahmos missiles to Philippines today

- Congress corporator’s daughter stabbed to death in college, attack on CCTV

- New residential complex for the judges inaugurated in Mangaluru

- Absconding accused nabbed after 8 years

- Truck with cylinders turns turtle in Beltangady

- Bhoota Kola artist dies of cardiac arrest

- Development of the country should be our goal: Ganesh Karnik

- Container truck gets stuck under Modankap railway bridge

- Truck crushes bike’s pillion rider near BC Road

- Head constable dies of heart attack

- Udupi: PDO dismissed over financial irregularities

- CREDAI to resume Skill Development Program for Construction Workers in Mangaluru

- John B Monteiro elected president of Rachana Catholic Chamber of Commerce & Industry

- Sudhanshu Rai elected district president of All College Student Association

- Chief Minister to visit Mangaluru, Udupi on August 1

- Nitte University awards PhD degree to Tina Sheetal D’Souza

- Sachitha Nandagopal honoured by CMTAI for Community Service

- CITY INFORMATION

- TRAVEL

- TOURIST INFORMATION

- HEALTH CARE

- MISCELLANEOUS

Write Comment

Write Comment E-Mail To a Friend

E-Mail To a Friend Facebook

Facebook Twitter

Twitter  Print

Print